“The PyxisCare team examines the medical, psychological, and spiritual needs of every client and family member, and I’m grateful to bring my experience as a certified rehab nurse to the team..”

— Yolanda R., PyxisCare Nurse Client Advocate, CRRN, Nurse Client Advocate

Supporting her mom with diabetes care inspired Yolanda to learn everything she could about the disease, and her mother’s wellness plan. As an adult, she has earned multiple degrees and certificates in the healthcare field. Now she brings her experience of helping others, with a specialty in rehab services, to the PyxisCare team as a Nurse Client Advocate (NCA) based in the Houston area.

Supporting her mom with diabetes care inspired Yolanda to learn everything she could about the disease, and her mother’s wellness plan. As an adult, she has earned multiple degrees and certificates in the healthcare field. Now she brings her experience of helping others, with a specialty in rehab services, to the PyxisCare team as a Nurse Client Advocate (NCA) based in the Houston area.

How did you chose nursing as your career path?

My mom was diagnosed with diabetes when I was a child, and I helped by giving her insulin injections. This sparked my curiosity and I researched how insulin works and how diabetes affects the body. With this knowledge, I taught my mom how to inject herself by the time I graduated from high school. After high school, I attended college and graduated with a bachelor’s degree in sociology and another degree in nursing. Studying sociology helped me understand how our healthcare system affects people of different socioeconomic backgrounds, and with my nursing degree I put this knowledge to use taking care of patients. Since then, I have earned a master’s in nursing leadership and management.

After college I worked at a rehab facility caring for patients with traumatic brain and spinal cord injuries, and other complex medical conditions. Additionally, I served as a clinical rehab liaison where I evaluated patients in acute hospital settings to determine if they were ready to go home or needed to transfer to a rehab facility. For rehab, the patient needs to tolerate three hours of therapy a day. Going home requires an understanding of how their medical condition affects their daily living. Will they need a heart monitor or oxygen? Will the patient have incontinence issues and how can they be supported? Does the patient require 24-hour supervision and how will this be provided?

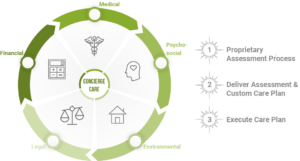

At PyxisCare, I’m very fortunate to employ all the skills I’ve gained over my clinical career. We examine and make recommendations for the medical, psychological and spiritual needs of every client and family member. I’m grateful to bring my experience to this team.

What is your role at PyxisCare?

As an NCA, I am the first face our clients see. I partner with the talented PyxisCare team to provide integrated care coordination and health care solutions. Many of our clients and families struggle with complicated, multifaced medical situations. For example, I recently worked with a grandmother who was the sole provider for her grandson with a medically complex condition. Our team helped find respite care for the grandmother, transportation to and from appointments, and worked with the child’s school so that they were compliant with their responsibilities regarding the American with Disabilities Act (ADA).

What unique skills do you bring to PyxisCare?

As a certified rehab nurse, I have years of experience supporting clients with many conditions. Additionally, I have extensive experience working with clients facing bladder dysfunction and incontinence. This is a sensitive topic that must be handled with delicacy and compassion. I educate clients facing this challenge with professionalism and kindness. I am grateful to be a resource for other PyxisCare team members with clients facing these issues.

Why did you choose PyxisCare?

When PyxisCare was expanding their team in Houston and central Texas, I thought, “Wow, this would be a great fit for me because I love advocating for patients and families.” I enjoy being part of a team that provides expertise, personalized service, and an integrated approach to managing the complexities of healthcare challenges. The team is very supportive, and we work well together.

My career has spanned more than twenty years of experience as a nursing professional with a variety of roles in clinical, compliance, regulatory, managerial, and risk management areas of nursing expertise.

My career has spanned more than twenty years of experience as a nursing professional with a variety of roles in clinical, compliance, regulatory, managerial, and risk management areas of nursing expertise. Happy Thanksgiving Friends,

Happy Thanksgiving Friends,

At my house, we’ve just survived back-to-school season – the drama of haircuts, new uniforms neatly pressed, the books, the backpacks and the return to early mornings, after school activities and late-night studying. These few weeks have been a headache of summer homework and finding the right school supplies. And now we have two teens who are studiously – if not happily – back to school.

At my house, we’ve just survived back-to-school season – the drama of haircuts, new uniforms neatly pressed, the books, the backpacks and the return to early mornings, after school activities and late-night studying. These few weeks have been a headache of summer homework and finding the right school supplies. And now we have two teens who are studiously – if not happily – back to school.

I founded PyxisCare more than 12 years ago to help people in a way that I hadn’t seen done before. Our team could make a difference – I was certain – and I believe we have. Over those years we’ve become much more sophisticated as a company, serving hundreds of individuals and partnering with many companies to offer peace of mind, better health and wellness.

I founded PyxisCare more than 12 years ago to help people in a way that I hadn’t seen done before. Our team could make a difference – I was certain – and I believe we have. Over those years we’ve become much more sophisticated as a company, serving hundreds of individuals and partnering with many companies to offer peace of mind, better health and wellness.