“Our support allows clients to know and utilize the best possible options both in quality and cost.” — Angela Smith

Angela is a nationally Certified Healthcare Access Associate with expertise in insurance verification and background. She has been working with insurance for over 25 years and it is one of her joys to help people meet their healthcare goals.

Help us establish some basics and tell us about the different parts of Medicare.

As of 2021, Medicare includes Part A which is inpatient and Part B which is outpatient services which includes doctor’s visits, radiology, and any other high-tech services. At this time, Medicare does not cover certain outpatient services like dental, vision, and bariatric surgery which are highly requested benefits for Medicare patients.

We are seeing promotions for Medicare Advantage and Part C. Can you give us an overview? Medicare Advantage plans allow you take your Medicare Plan A or B and sign it over to a more structured benefit plan with a company like United Healthcare, Humana, Aetna or Cigna. These offer plans for a more structured benefit and the ability go to specific doctors and hospitals. They also cover what traditional Medicare will not cover, such as dental and vision. While traditional Medicare A or B is administered by the government, Medicare Advantage Plans or Part C are administered by private carriers and are more comprehensive.

Both plans also offer the drug benefit, which traditional Medicare does not offer. The drug benefit is highly recommended as most Medicare patients have high-cost medications and they don’t have a supplement plan which is usually obtained with traditional Medicare. The high cost of medication can be prohibitive for many older adults. The drug plan is known as Part D acquired either through a Medicare Advantage Plan or a supplement plan with traditional Medicare. So the options are either to acquire traditional Medicare Part A and B plus a supplement or a Medicare Advantage Plan which offers the same benefits of the traditional Medicare Parts A, B, C, and D.

Let’s talk about enrollment and eligibility. Who is currently eligible for Medicare?

Traditional Medicare is for people 65 or older or who qualify for disability. Individuals are NOT automatically enrolled in Medicare at 65. Go to medicare.gov or ssa.gov to learn more. If you do not enroll upon turning 65, there are penalties for a later enrollment.

Are you enrolled in Part A and Part B at the same time or are they separate enrollments?

Enrollment is traditionally based on need. Some people only get Part A with a supplement. You do not automatically qualify for A and B. It is based on your social security status and how long you have worked. They tell you what you qualify for.

Do you suggest adults approaching age 64 find someone who will guide them in their choices Is that correct? Absolutely. No one wants to choose incorrectly or accrue penalties. Traditional Medicare only covers 80% and you are responsible for the other 20% unless you have a supplement. If you have a supplement plan, they pick up the 20%. But supplement plans are expensive and don’t cover everything you need including medications, supplies, some dental, and some chiropractic.

What if you are still working at age 65? Should you still enroll in Medicare?

Yes, you should. You should always enroll in Medicare. Your employer’s insurance will be primary and Medicare will be secondary.

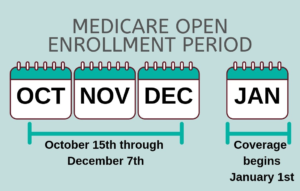

We are in open enrollment now! Can you share any new or exciting changes?

Of course! This coming year, Medicare Advantage Plans are offering meals delivered to your home and physical fitness options for seniors for gyms and physical fitness plans. They are also offering an allotment each month for over-the-counter medicines to be delivered to your home including Tylenol, cough syrup and cough drops.

Where is the best place to find information online? My favorite website to go to for open enrollment is Ehealth.com. It allows you to input your information without commitment an is the best online navigator I’ve come across. You include your doctor’s information and medications. It also allows you to compare which plans are best for you in your designated area. Unlike Medicare.gov, which is not customer friendly, Ehealth breaks down everything for you and shows you your estimated costs for the year based on your location, medications, and the services you need.